New 3.8 percent tax on investment income will take effect

Shortly after federal government enacted healthcare reform in 2010, there was considerable concern over a last-minute addition to the legislation: a 3.8% tax on investment income of upper-income households to help shore up Medicare. The tax takes effect on January 2013.

Passed by Congress in 2010 with the intent of generating

an estimated $210 billion to help fund President Barack Obama’s health care

and Medicare overhaul plans — could be relevant to your clients.

Understand that this tax WILL NOT be imposed on all real estate transactions,

a common misconception. Rather, when the legislation becomes effective in 2013,

it may impose a 3.8% tax on some (but not all) income from interest, dividends,

rents (less expenses) and capital gains (less capital losses). The tax will fall only

on individuals with an adjusted gross income (AGI) above $200,000 and couples

filing a joint return with more than $250,000 AGI.

Applies to: Individuals with adjusted gross income (AGI) above $200,000

Couples filing a joint return with more than $250,000 AGI

Types of Income: Interest, dividends, rents (less expenses), capital gains

(less capital losses)

Formula: The new tax applies to the LESSER of Investment income amount

Excess of AGI over the $200,000 or $250,000 amount

New tax, dedicated to Medicare funding, is imposed on the so-called “earned” income of higher income individuals. Th is earned income tax has a much lower rate of 0.9% (0.009). Like the tax

described in this brochure, this additional or alternative tax is based on adjusted gross income thresholds

of $200,000 for an individual and $250,000 on a joint return. Like the 3.8% tax, this 0.9% tax is imposed

only on the excess of earned income above the threshold amounts.

Another way of thinking about these new taxes is to think of the 3.8% tax as being imposed on a portion

of the money that you make on your money — your capital (sometimes referred to as “unearned income”).

Th e 0.9% tax is imposed on a portion of the money you make on your labor — your salary, wages,

commission and similar income related to earning a livelihood.

★

|

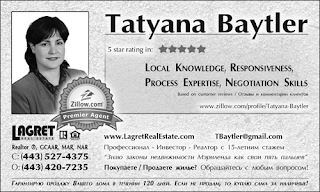

| Call Tatyana Baytler: Real Estate Broker - 443-527-4375 |

No comments:

Post a Comment